You don’t have to know a lot about money to be smart with money.

Being smart with your money is about knowing yourself and your strengths and weaknesses, and then setting things up accordingly.

It’s about building habits to carry you when you’re willpower stumbles.

Key Takeaways:

- Set life goals—big and small, financial and lifestyle—and create a blueprint for achieving those goals.

- Make a budget to cover all your financial needs and stick to it.

- Pay off credit cards in full, carry as little debt as possible, and keep an eye on your credit score.

- Create automatic savings by setting up an emergency fund and contributing to your employer’s retirement plan.

- Take care of your belongings—maintenance is cheaper than replacement—but most importantly, take care of your health.

Set Life Goals

It can be hard to stick to your savings budget, especially when you have to give up on yet another thing to make it happen.

But you’ll likely feel less of a twinge when you have to skip that extra drink when you remember the money’s going towards something you really want.

Whether it’s a holiday, a house, retirement, or even a less responsible-sounding purchase such as a flash new tattoo, it’s great to have a goal.

Make a Monthly Budget

Pay yourself first. Enroll in your employer’s retirement plan and make full use of any matching contribution benefit, which is essentially free money. It’s also wise to have an automatic withdrawal into an emergency fund, which can be tapped for unexpected expenses, as well as an automatic contribution to a brokerage account or something similar.

Ideally, the money for the emergency fund and the retirement fund should be pulled out of your account the same day you receive your paycheck, so it never even touches your hands.

Keep in mind that the recommended amount to save in an emergency fund depends on your individual circumstances. Also, tax-advantaged retirement accounts come with rules that make it difficult to get your hands on your cash should you suddenly need it, so that account should not be your only emergency fund.

Note

Negotiate for Goods and Services

Many people are hesitant to negotiate for goods and services, because they’re afraid that it makes them seem cheap. Conquer this fear and you could save thousands each year. Small businesses, in particular, tend to be open to negotiation, so buying in bulk or positioning yourself as a repeat customer can open the door to good discounts.

Stay Educated on Financial Issues

Review relevant changes in tax law to ensure that all adjustments and deductions are maximized each year. Keep up with financial news and developments in the stock market and do not hesitate to adjust your investment portfolio accordingly. Knowledge is also the best defense against fraudsters who prey on unsophisticated investors to turn a quick buck.

Maintain Your Property

Taking good care of property makes everything from cars and lawnmowers to shoes and clothes last longer. The cost of maintenance is a fraction of the cost of replacement, so it’s an investment not to be missed.

Pro Tip

Learn to know the difference between the things you want and the things you need.

Track your spending

Doesn’t matter how you do it, just do it: use a spreadsheet, a notebook, or one of the countless personal budget apps available.

Seeing exactly where all your money is going can be the wakeup call you need to change your behaviour and get on track.

Learn however you can

Finance, investing, and optimizing your finances generally? Well, they can seem a bit scary. Rather than waiting until you need to know something specific — oh God, what’s the best way to set up this investment property so I don’t lose everything to tax? — start consuming information earlier on. Whether it’s books, blogs, podcasts, or videos, find a few you like, and let your brain start absorbing the information. Over time, you’ll develop a general understanding of how things work, which will make your research and decisions easier when the time comes.

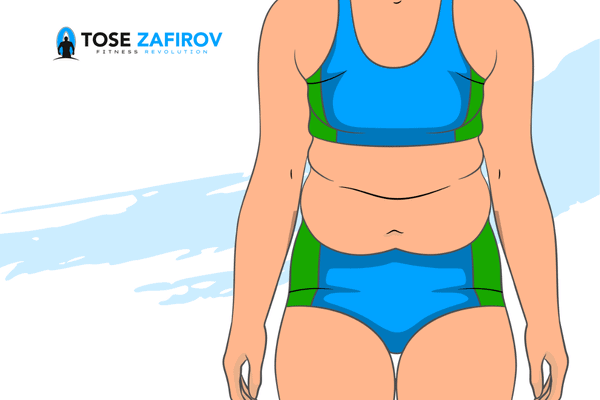

Take Care of Your Health

The principle of proper maintenance also applies to your body—and taking excellent care of your physical health has a significant positive impact on your financial health as well.

Investing in good health is not difficult. It means making regular visits to doctors and dentists, and following health advice about any problems you encounter. Many medical issues can be helped—or even prevented—with basic lifestyle changes, such as more exercise and a healthier diet.

Poor health maintenance, on the other hand, has both immediate and long-term negative consequences on your financial goals. Some companies have limited sick days, which means a loss of income once paid days are used up. Obesity and other dietary illnesses make insurance premiums skyrocket, and poor health may force early retirement with lower monthly income for the rest of your life.

LEARN THE BASICS OF INVESTING.

Investing helps make your money work for you. Once you have some extra income that goes beyond your regular expenses, you may be ready to start investing. Grow your money and build wealth in the long run without too much extra effort. Check out my group for more advice

TEAM UP WITH YOUR PARTNER.

Whatever you do, don’t ignore money talks with your partner. For a happier relationship that stands the test of time with less stress, be open about money. Consider how to manage your money together and how you can plan a combined financial future.

STAY UP TO DATE ON FRAUD AND SCAMS.

Identity theft is a real threat. It can negatively impact your credit while also taking up mountains of your time to untangle and reemerge. Look for ways to protect yourself and any dependents from identity theft. These include monitoring your credit report and keeping important identification information (like Social Security numbers) secure.

Bottom Line:

Becoming more financially intelligent is a journey that requires commitment, education, and discipline. By setting clear goals, developing budgeting skills, investing wisely, and seeking professional advice, you can enhance your financial literacy and make informed decisions. Remember to track your progress, overcome challenges, and remain patient and adaptable along the way. With a proactive and strategic approach, you can build a solid foundation for financial success and enjoy a more secure and prosperous future.